🇫🇷 Version française à la fin de ce message

Summary of the proposal:

This proposal aims to update the positions of the liquidity provided (in November 2024) by the DAO via a SushiSwapp v3 REG/USDC pool cf [RIP000003].

The parity of the REG having fallen since the initial deposit: $1.84 at the time of the deposit vs. $1.58 currently (-14%), it is proposed to authorize RealT, which manages the safewallet of this budget for the DAO, to do the following:

- withdrawal of 10K REG from the 2.35/3.17 USDC range to deposit them on a range going from the current parity at the time of the action to $1.84 (start of the next range),

- and adjustment of the parity range of the deposit of the 100K REG, by reducing its low value to the price at the time of the action, and its high value from $10 to $4,

- If the parity fell again and reached $1.4 (- 11%): Repeat the first action to recycle part of the REG from the 2.35/3.17 USDC range to a lower range.

- If the parity increased and exceeded the new range of the current deposit: Withdraw the USDC from this range to transfer them to the DAO treasury. Do the same if the next range was exceeded.

Motivation:

In order to increase the liquidity of the REG, the DAO created a pool with only REG in order to:

- facilitate the purchase of REG,

- limit slippage when exchanging REG for USDC,

- stabilize the price of REG (upwards),

- sell REG for USDC in order to feed the DAO treasury,

- collect fees (1%) during swaps on this pool.

The pool, created by RIP00003, must be managed to take into account variations in the parity of the REG.

RIP00003 provided for the creation of a Management Committee to do this.

This proposal mandates RealT to take some initial actions to manage the pool, while the Committee is being set up.

Context:

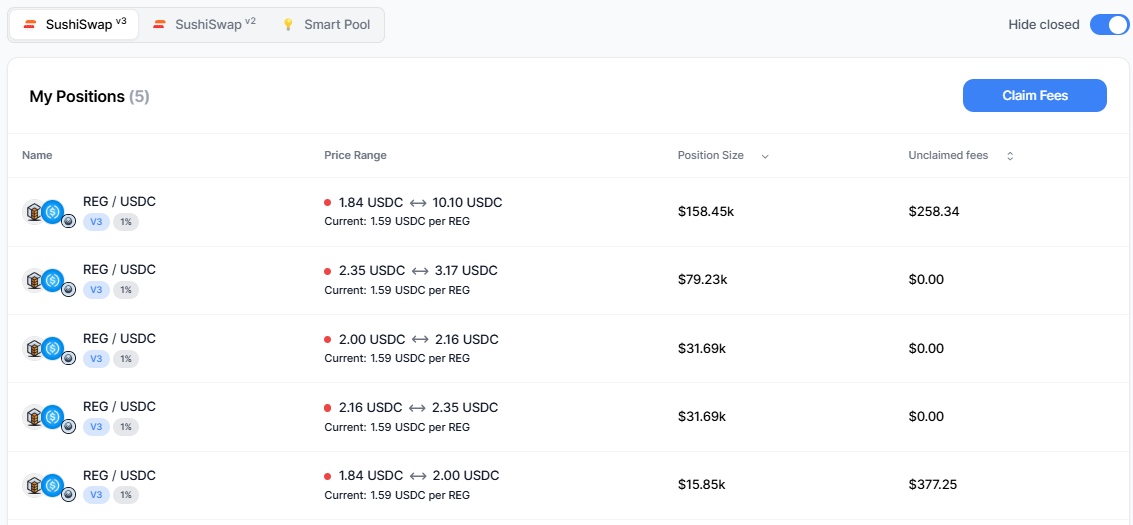

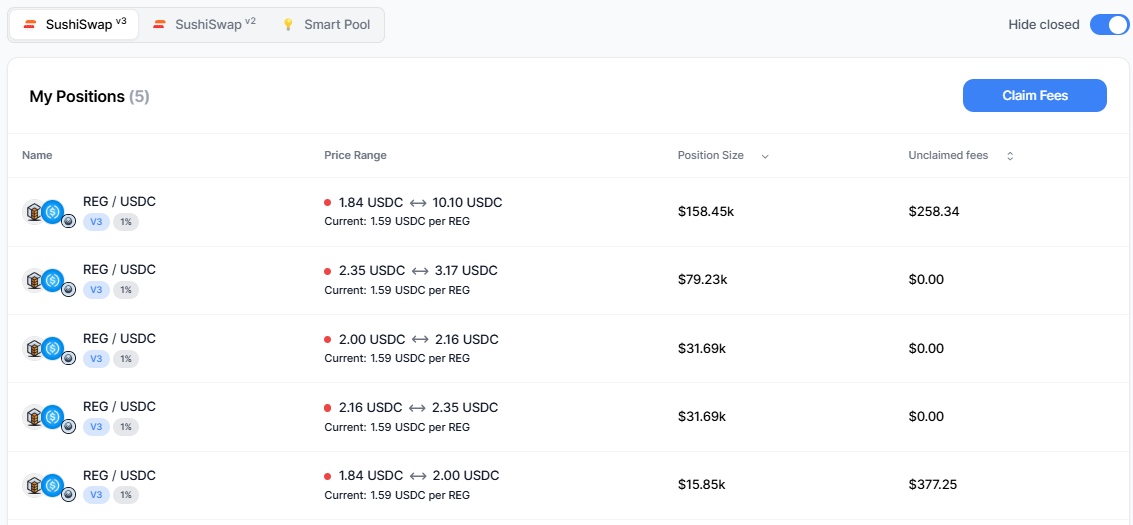

Since its creation (November 25, 2024: Michael-RealT), the pool has:

- contributed to the purchase of REG (USDC > REG), during the phase of increase of the REG parity,

- contributed to the sale of REG (REF > USDC), during the phase of decrease of the REG parity (since the end of January 2025),

- the parity of the REG being currently lower than the 5 ranges originally set up, all the ranges are "out-of-range" and therefore inactive,

- the swaps carried out on the pool have generated fees for the benefit of the DAO (258 + 377 $),

The management strategy of the sushiswap pool had been described during the prior discussions on the Forum:

This proposal punctually gives RealT a mandate to operate this strategy, while the Management Committee is being set up (see duration of setting up the Security Committee).

In the bearish context of the REG parity, placing a range below the lowest originally positioned (at $1.84) will allow:

- to contribute to the purchase of REG (USDC > REG), if the REG parity increased and was in the new range,

- if the parity continues to fall, this range will be inactive but ready to collect USDC when the price rises.

The budget allocated in RIP00003 is unchanged, since it is a part of the 50 K REG of the 2.35/3.17 USDC range that are used to create this new range. This proposal will therefore not increase the number of REG in circulation.

The number of REG allocated to this new range (10K) corresponds approximately to the quantity of REG that would currently have to be purchased to bring the parity back to $1.84 (threshold of the original ranges).

Pool management actions are subject to a vote by the DAO, i.e. at least 7 days of debate on the Forum + 10 days of voting on Tally.

In order to increase the responsiveness of pool management, in light of REG fluctuations: this proposal has been supplemented by a mandate given by the DAO to RealT in order to:

- be able to recreate a new range, below the existing ones, if the REG parity fell below $1.4 again,

- and conversely if the parity rose, to be able to transfer the collected USDC as soon as the parity moved to the higher range.

Without this last authorization of action, the collected USDC could disappear again when the parity fell (see what happened since the creation of the pool).

Implementation steps:

- Preliminary discussions on the Forum, to explain and finalize the proposal: duration 10 days,

- Vote on the proposal on Tally: 10 days,

- Application of the decision, if favorable vote, by RealT: early March (therefore in the parity conditions of the REG of the moment!),

- in parallel, the process of constituting the Management Committee was launched.

Team:

- Propose them: to structure and vote on this proposal as well as that of the constitution of the Committee,

- RealT: to give an opinion during the preliminary discussions, then act after the vote,

- The members of the DAO: to contribute to the preliminary discussions, vote on this proposal and contribute to the constitution of the Management Committee.

Budget:

None.

Roadmap:

- Deal with the most urgent, by giving a mandate to RealT to carry out the pool management acts according to: the initial management strategy and the variations in the REG price,

- Set up a Management Committee, so that the DAO: takes up these management acts, updates the initial management strategy and sets up the necessary tools.

Goals:

Unchanged vs RIP00003

- Make it easier for newcomers and existing holders to buy REG

- Reduce manipulation risks

- Reduce transaction slippage

- Acquire stablecoins to fund the DAO treasury

Success Metrics:

Unchanged vs RIP00003:

- Increase the price of REG gradually

- Increase the total number of wallets holding REG

- Increase the average number of REG per wallet

- Increase trading volumes

Key Terms:

Unchanged vs RIP00003:

- REG: DAO governance token

- Sushiswap v3: Decentralized exchange platform with concentrated liquidity pools

- Concentrated liquidity: A method of providing liquidity within specific price ranges

- Safe: A smart contract that allows funds to be managed securely with multiple signatures

- Slippage: Difference between the asking price and the actual price of a transaction

.

🇫🇷 ============================================================

Résumé de la proposition:

Cette proposition vise à actualiser les positions de la liquidité apportée (en novembre 2024) par la DAO via une pool SushiSwapp v3 REG/USDC cf [RIP000003].

La parité du REG ayant baissée depuis le dépôt initiale : 1,84$ au moment du dépôt vs 1,58$ actuellement (- 14%), il est proposé de donner l'autorisation à RealT qui gère pour la DAO le safewallet de ce budget de faire les actions suivantes :

- retrait de 10 K REG du range 2,35/3,17 USDC pour les déposer sur un range allant de la parité en cours au moment de l'action jusqu'à 1,84$ (début du range suivant),

- et ajustement du range de parité du dépôt des 100 K REG, en réduisant sa valeur basse au cours au moment de l'action, et sa valeur haute de 10 à 4 $,

- Si la parité baissait à nouveau et atteignait 1,4$ (- 11%) : Renouveler la première action pour recycler une partie des REG du range 2,35/3,17 USDC vers un range plus faible.

- Si la parité augmentait et dépassait le nouveau range du présent dépôt : Retirer les USDC de ce range pour les transférer vers la trésorerie de la DAO. Faire de même si le range suivant était dépassé.

Motivation:

Afin d'augmenter la liquidité du REG, la DAO a créé une pool dotée uniquement de REG afin :

- faciliter l'achat de REG,

- de limiter le slippage lors des échanges de REG contre des USDC,

- stabiliser le cours du REG (à la hausse),

- de vendre des REG contre des USDC afin d'alimenter la trésorerie de la DAO,

- de collecter les frais (1%) lors des swap sur cette pool.

La pool, créé par la RIP00003, doit être gérée pour tenir compte des variations de la parité du REG.

La RIP00003 prévoyait la création d'un Comité de gestion pour ce faire.

La présente proposition donne mandat à RealT pour faire quelques premières actions de gestion de la pool, le temps que le Comité se mette en place.

Contexte:

Depuis sa création (25 Novembre 2024 : Michael-RealT), la pool a :

- contribuée à l'achat de REG (USDC > REG), lors de la phase d'augmentation de la parité du REG,

- contribuée à la vente de REG (REF > USDC), lors de la phase de baisse de la parité du REG (depuis fin janvier 2025),

- la parité du REG étant actuellement inférieur aux 5 ranges mis en place à l'origine, l'ensemble des ranges sont "out-of-range" donc inactifs,

- les swap réalisés sur la pool on généré des frais au profit de la DAO (258 + 377 $),

La stratégie de gestion de la pool sushiswap avait été décrite lors des échanges préalable sur le Forum :

La présente proposition donne ponctuellement mandat à RealT pour opérer cette stratégie, le temps que le Comité de gestion soit mis en place (cf durée de mise en place du Comité sécurité).

Dans le contexte baissier de la parité du REG, placer un range en dessous du plus bas positionné à l'origine (à 1,84$) permettra :

- de contribuer à l'achat de REG (USDC > REG), si la parité du REG augmentait et se trouvait dans le nouveau range,

- si la parité continue de baisser, ce range sera inactif mais prêt pour collecter des USDC lors de la remonté du cours.

Le budget alloué en RIP00003 est inchangé, puisque c'est une partie des 50 K REG du range 2,35/3,17 USDC qui sont utilisés pour créer ce nouveau range. La présente proposition n'augmentera donc pas le nombre de REG en circulation.

Le nombre de REG affecté à ce nouveau range (10K) correspond environ à la quantité de REG qu'il faudrait acheter actuellement pour faire revenir la parité à 1,84$ (seuil des range d'origine).

Les actions de gestion de la pool sont soumises au vote de la DAO, soit au minimum 7 jours de débat sur le Forum + 10 jours de délai de vote sur Tally.

Afin d'augmenter la réactivité de la gestion de la pool, au regard des fluctuations du REG : la présente proposition a été complétée d'un mandat donné par la DAO à RealT afin de :

- pouvoir recréer un nouveau range, en dessous des existants, si la parité du REG baissait à nouveau en dessous de 1,4$,

- et à l'inverse si la parité remontait, de pouvoir transférer les USDC collectés dès que la parité passe au range supérieur.

Sans cette dernière autorisation d'action, les USDC collectés pourraient redisparaitre lors d'une baisse de la parité (cf ce qui s'est passé depuis la création de la pool).

Étapes d'implémentation:

- Echanges préalables sur le Forum, pour expliquer et finaliser la proposition : durée 10 jours,

- Vote de la proposition sur Tally : 10 jours,

- Application de la décision, si vote favorable, par RealT : début mars (donc dans les conditions de parité du REG du moment !),

- en parallèle a été lancée la démarche de constitution du Comité de gestion.

Equipe:

- Les Proposer : pour structurer et faire voter cette proposition ainsi que celle de constitution du Comité,

- RealT : pour donner un avis lors des échanges préalables, puis agir à l'issue du vote,

- Les membres de la DAO : pour contribuer aux échanges préalables, voter la présente proposition et contribuer à la constitution du Comité de gestion.

Budget:

Aucun.

Feuille de route:

- Parer au plus pressé, en donnant mandat à RealT pour faire les actes de gestion de la pool en fonction : de la stratégie de gestion initiale et des variations du cours du REG,

- Constituer un Comité de gestion, pour que la DAO : reprenne ces actes de gestion, actualise la stratégie de gestion initiale et mette en place les outils nécessaires.

Objectifs :

Inchangés vs RIP00003

- Faciliter les achats de REG pour les nouveaux arrivants et les anciens détenteurs

- Réduire les risques de manipulation

- Diminuer le slippage des transactions

- Acquisition de stablecoin pour alimenter la trésorerie de la DAO

Métriques de succès:

Inchangés vs RIP00003 :

- Augmentation progressive du prix du REG

- Accroissement du nombre total de wallets détenant des REG

- Augmentation du nombre moyen de REG par wallet

- Augmentation des volumes d'échange

Termes clés:

Inchangés vs RIP00003 :

- REG : Token de gouvernance de la DAO

- Sushiswap v3 : Plateforme d'échange décentralisée avec des pools de liquidité concentrés

- Liquidité concentrée : Méthode permettant de fournir de la liquidité dans des fourchettes de prix spécifiques

- Safe : Contrat intelligent permettant de gérer les fonds de manière sécurisée avec plusieurs signatures

- Slippage : Différence entre le prix demandé et le prix réel d'une transaction

.

============================================================

📍 CHECK-LIST: ( 🔲 : under discussion / ✅ : finalized / ❎: not applicable )

✅ Proposal Summary

✅ Motivation

✅ Context

✅ Implementation steps

✅ Team

✅ Budget / Allocation

✅ Roadmap

✅ Objectives

✅ Key terms

.